- Your Expected Retirement Costs – seeking the correct retirement plans ought to consist of an evaluation of your anticipated pension expenses. These prices can be different for each person, as well as the ideal arrangement for your pension will enable you to save the amount of cash that you expect to need when you choose to retire. Some plans might maybe not provide investment options that will offer the return required to attain the desired account stability. Make sure that you feature all of the possible expenditures experienced after pension; usually, you could pick a strategy that drops short.

- Your Anticipated Plan Contributions Every 12 months – The plan you like should factor in your yearly anticipated contributions and ensure that your retirement objectives can be accomplished. Some plans may limit permitted efforts to a little amount on an annual foundation, and some plans may allow get-up contributions when you have close to retirement age.

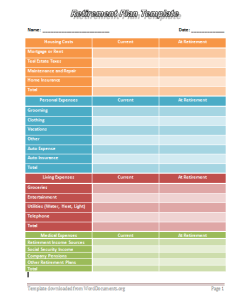

- Taxation preparation Advice – Finding the greatest retirement plans ought to include expert income tax advice. The consequences of poor pension preparation can be large income tax debts, at a time when your earnings are needed the absolute many. Some programs utilize pre-tax efforts that are taxed upon circulation, while various other plans make use of contributions made on an after-tax basis so withdrawals are maybe not taxed after pension. Tax advice can help you select just the right plans for all of your pension needs and objectives. Click here to download this Retirement Plan Template

- A selection of Retirement Goals – Before determining the best program for your monetary protection during retirement you need to create a list of your pension goals. Will you would you like to travel? Will you hold a next home? Will you work a part-time job and take up a pastime with associated expenditures? Your retirement targets will influence the greatest program for your future, plus the amount of retirement income you need to live on without monetary problems after retiring.

- A Professional Financial Planner – a monetary planner will allow you to pick the best retirement plans for the special targets and financial needs at this time in your lifetime. A monetary planner shall assist you to create financial objectives, and next outline steps you’ll want to simply take therefore that these goals can effortlessly be met.

- An excellent Retirement Calculator – An Excellent pension calculator makes it possible to precisely calculate all of the costs you are going to have once you retire. This would be among the primary steps in pension planning to make certain that you perform and perhaps not stop up quick on funds in your golden years. These tools can really assist determine unexpected costs and expenditures which you may not have considered.

- Your Annual Income Amount – Some pension programs have actually certain restrictions concerning annual income quantities for eligibility. Many 401K plans, IRA accounts, and various other retirement options might not be open to large earnings earners. Some plans can be intended for small businesses or self-employed people, while some are intended for large-earnings staff members, and still, others may be ideal for low-earnings wage earners. You are going to have to understand the annual quantity that you earn to figure out which program is appropriate for your pension needs.

Tag Archives: need to retirement